It is often said that is it better to give than to receive, but what if you could do both? Charitable trusts can accomplish just that, and you don’t have own a private jet or a luxury yacht to establish one. The two most common types of charitable trusts are charitable lead trusts and charitable remainder trusts, with the main difference between the two being who receives the income stream vs. who receives the remainder interest when the trust ends.

A charitable lead trust (CLT) is established to provide an income stream to a charity (or Donor Advised Fund) of your choice. At the end of the trust term, which is for a set period of years or the life of one or more individuals, the remaining assets pass to a non-charitable beneficiary of the donor’s choice.

A charitable remainder trust (CRT) is just the opposite. During the term of the trust, a non-charitable beneficiary receives an income stream for life or a set term of not more than twenty years, and at the end of the trust the remaining funds go to a charitable beneficiary.

There are a variety of situations where why one might consider including a charitable trust as part of their overall tax and estate plan such as:

- A client has a large IRA and they are concerned about their heirs being forced to withdraw the entire account balance within ten years under the new SECURE Act rules.

- A closely held business owner is anticipating a high-income tax year / liquidity event and could benefit from a large charitable deduction.

- A taxpayer has a portfolio of low basis, highly appreciated assets and is interested in ways to diversify his holdings while minimizing the tax impact.

But most important, any client considering a charitable trust must have charitable intent because ultimately a portion of the funds will go to charity under any these strategies.

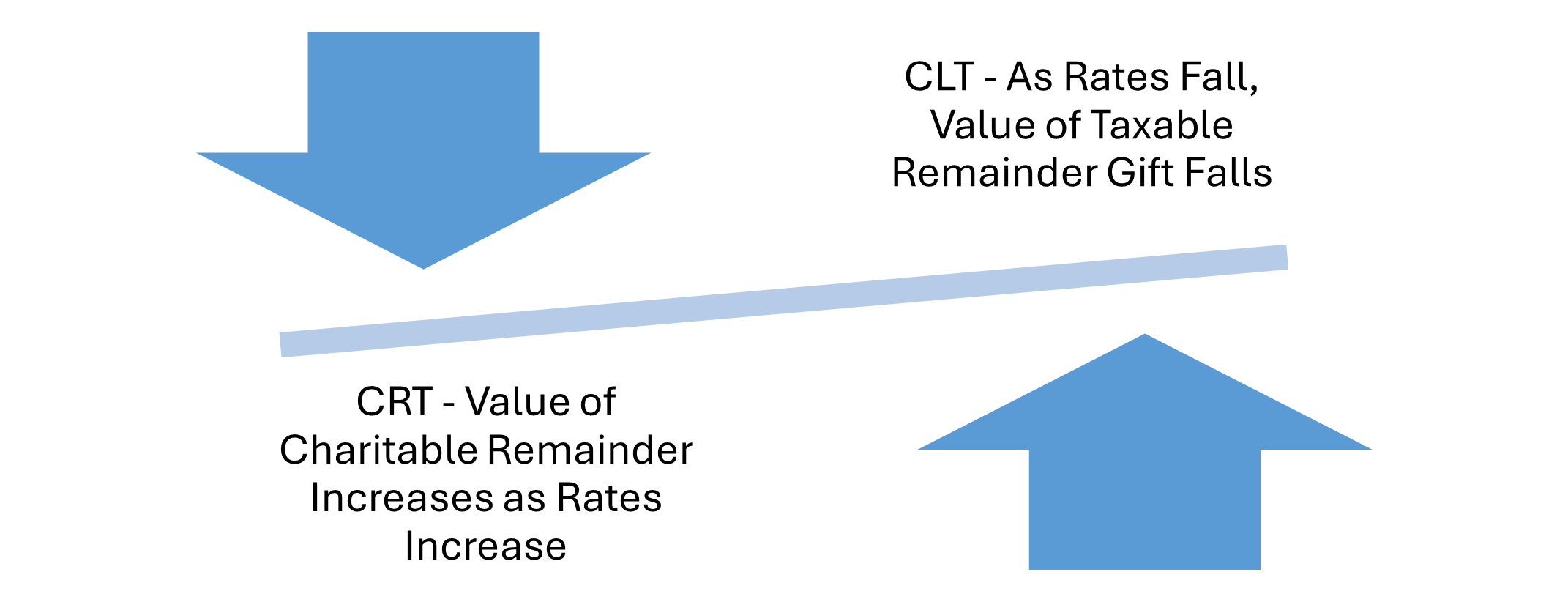

By way of background, each month, the IRS publishes key interest rates used in wealth transfer strategies known as the Applicable Federal Rates (AFRs). When valuing the remainder interests for charitable trust planning, we rely on the Sec. 7520 rate, which is 120% of the midterm AFR interest rate. Changes in this rate are critical; when rates were very low as they were back in 2021, Charitable Lead Trusts (CLTs) were a popular planning tool. Now with current Sec. 7520 rate for November 2024 at 4.4%, Charitable Remainder Trusts (CRTs) are more often used. So why is that?

It all comes down to how the income tax charitable deduction and transfer tax (gift/estate) remainder interest are valued.

- With a CLT, the charity gets an income stream first and non-charitable beneficiary(s) get the remaining funds at the end. When the Sec. 7520 rate is low, the present value of the remainder interest (i.e. the “taxable gift “) is lower. This means a donor can make a gift to his beneficiaries and use less of his lifetime gift/estate exemption.

- On the other hand, with a CRT, the non-charitable beneficiary(s) gets the upfront income stream, and the charity gets what is left at the end. When the Sec. 7520 rate is higher, this provides a greater charitable contribution deduction for income and gift/estate tax purposes.

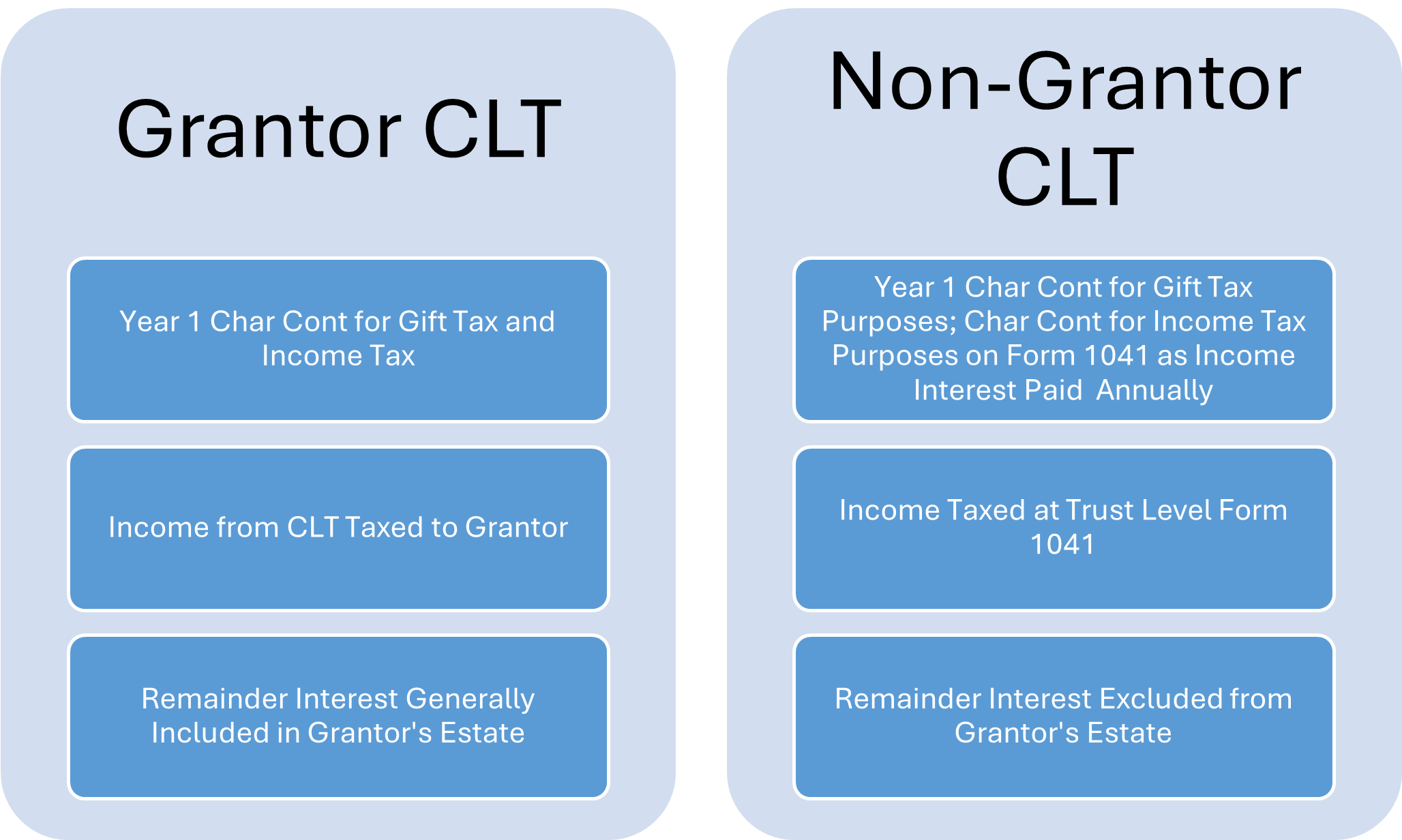

CLTs can be established as either grantor or non-grantor trusts depending on the goals of the donor. A grantor CLT will allow the donor to take an upfront income tax charitable deduction in year one, but at the cost of paying tax on the trust income annually throughout the trust term on his individual income tax return. Additionally, a grantor CLT generally does not remove the remainder interest from the grantor estate. A non-grantor CLT does not permit the same upfront year one income tax deduction, but instead permits the trust, which is taxed as a separate entity, to take a charitable deduction against trust income as the annuity payments are made to the charitable beneficiary. A non-grantor CLT is better suited for estate planning goals as both the charitable and the remainder interests are removed from the grantor’s estate.

A CRT is exempt from tax on income accumulated for future charitable distributions or as income is distributed to beneficiaries. This type of trust may be a useful tool for an investor holding low basis but highly appreciated assets. The CRT will take carryover basis on any assets contributed to it, but it will not recognize gain on the sale of the assets, increasing the after-tax cash flow.

With the changes made under the SECURE Act requiring inherited IRAs to be distributed within ten years of the owner’s death, a testamentary CRT as an IRA beneficiary could be an effective tool for individuals with large IRAs. The IRA owner would set up a CRT, establishing non-charitable income beneficiary(s) and a charitable remainder beneficiary, and name the trust as the beneficiary of their IRA. Upon their death, the IRA assets would pass to the CRT (and at that time, their estate would get a charitable deduction). The IRA assets would grow tax free within the trust because the CRT is exempt from tax. Each year during the term of the trust, the income beneficiaries would receive the required income payout as established in the trust document and report their share of the trust income. The term of the trust can be for the life of the beneficiary(s) or a period of years not to exceed 20 years. Effectively, the IRA withdrawal has now been stretched from the mandatory 10-year period to 20 years or perhaps longer. At the end of the trust term, the remainder goes to the charity.

If you have questions about how to incorporate a charitable trust in your retirement or estate plan, we are here to help. Contact us today to explore the best strategies tailored to your unique financial goals.